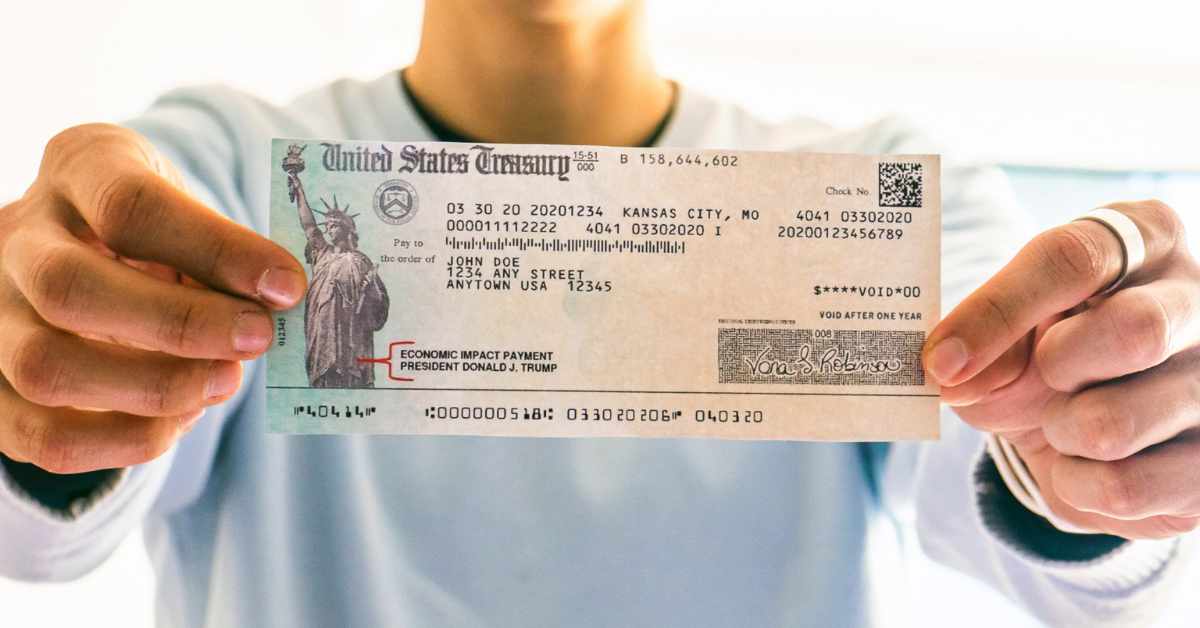

As anticipation builds among Americans, the possibility of a fourth round of IRS Tax Stimulus Checks looms on the horizon. This comprehensive guide delves into the essential aspects of these potential payments, including the expected amount, eligibility criteria, and steps to check payment status.

IRS Tax 4th Stimulus Check Ohio Amount

The fourth stimulus payment, ranging from $200 to $1,700, is a result of the recently approved American Rescue Plan by Congress. Families with at least four members can expect a $3,400 fund. The program allocates $1,400 stimulus payments to individuals earning up to $75,000 annually or $150,000 for married couples filing jointly. However, the payment decreases for those earning more than $75,000, with no payments for those earning over $99,000 annually.

IRS Tax 4th Stimulus Check Overview

- Handling Organization: Internal Revenue Service (IRS)

- Government Responsible: United States of America Government

- Aim: To provide financial assistance to the taxpayers of the USA

- Release Mode: State-wise Release

- IRS Stimulus 4 Expected Date: Expected in October 2023

- IRS Online Portal: IRS Official Website

IRS Tax Expected Date for Stimulus Check 4

While the IRS has not disclosed specific dates for releasing the fourth stimulus check, it is anticipated to be sent in October 2023. States will determine the release dates, and some have already begun mailing out checks. Eligible recipients are encouraged to stay informed about announcements from their respective states regarding the distribution of Stimulus Check 4 payments.

More Articles:

- Unmasking The 6400 Stimulus Check Scam: Protecting Citizens from Fraud

- Stimulus Check 2023: Unveiling State-Aid Breakdown

IRS Tax 4th Stimulus Check Recipient

According to the IRS, qualified recipients of the fourth stimulus check payment include:

- Child tax credit-eligible parents or guardians declaring their kids as dependents

- Individuals with an adjusted gross income (AGI) up to $75,000

- Married couples filing jointly with an AGI up to $150,000

- Heads of households with an AGI up to $112,500

Partial payments may still apply for individuals with incomes exceeding these limits. The payment amount decreases by $5 for every $100 increase in AGI beyond the threshold.

Steps to Check IRS Tax Fourth Stimulus Check Payment Status

Eligible taxpayers can check the status of their IRS Tax Fourth Stimulus Check payment through the following steps:

- Visit the official IRS website at irs.gov.

- Log in with your credentials to access the IRS Dashboard.

- Enter your social security number or tax ID and click submit.

- Locate the link to check the IRS Tax Fourth Stimulus Check payment status.

- Utilize this method to stay informed about the status of your IRS Fourth Stimulus Checks.

The relief fund, delivered via direct deposit, aims to uplift the financial status of U.S. citizens and alleviate tax burdens. For those seeking further clarification on this scheme, feel free to reach out with any queries.

We believe this article has provided valuable insights into the potential IRS Tax Fourth Stimulus Checks, aiding readers in understanding the intricacies of this financial assistance program.