Filing taxes is a meticulous process, and sometimes, errors or changes need to be addressed through an amended return. The Internal Revenue Service (IRS) provides a tool called “Where’s My Amended Return” to help taxpayers track the status of their amended returns. In this article, we will explore the intricacies of this tool, including when and how to check, eligibility for electronic filing, and common questions related to amended returns.

When to Check the Status?

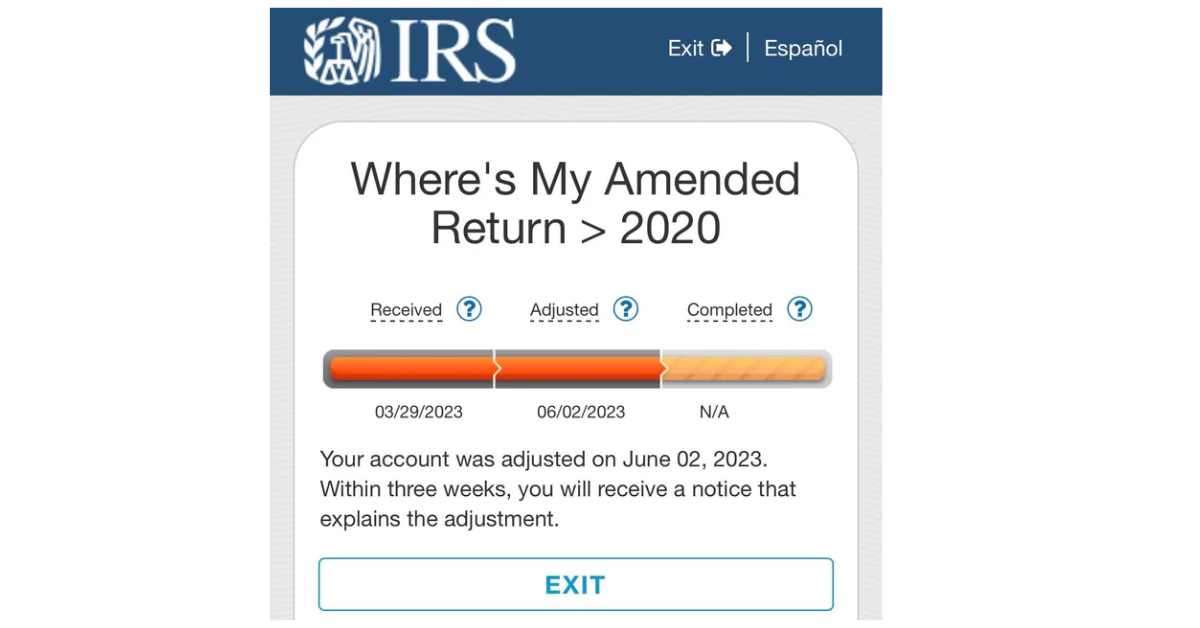

After submitting an amended return, individuals often wonder when they can check its status. The IRS informs that it takes up to three weeks for the amended return to appear in their system. The overall processing time can extend up to 16 weeks. To check the status, individuals can use the “Where’s My Amended Return” tool, available in both English and Spanish.

What You Need To Check The Status

To access the status of your amended return, you’ll need the following information:

- Social Security Number

- Date of Birth

- Zip Code

How to Use “Where’s My Amended Return” (Reddit Post)

The tool is user-friendly and can be accessed online. However, it’s important to note that certain amended returns cannot be accessed through this tool. Questions related to eligibility and frequently asked questions are addressed in the tool.

Common Questions About Electronic Filing:

- Can I File Electronically? Yes, the IRS allows electronic filing of amended returns (Form 1040-X) for tax years 2020, 2021, and 2022 using available tax software products.

- Reasons for Paper Filing: Amended returns older than three years (Form 1040 and 1040-SR) or two years (Form 1040-NR and 1040-SS/PR) cannot be filed electronically. If amending a prior year’s return filed on paper, the amended return must also be filed on paper.

- Filing for Previous Tax Years: Electronic filing is currently available for tax years 2020, 2021, and 2022 Forms 1040, 1040-SR, 1040-NR, and 1040-SS/PR.

- Processing Time for Electronic Returns: The processing time for both paper and electronically filed amended returns is more than 20 weeks, with no significant difference in speed.

- Direct Deposit for Amended Returns: Beginning in processing year 2023, direct deposit is available for electronically filed amended returns for tax year 2021 and tax year 2022.

Checking Status and FAQs

Individuals can use the “Where’s My Amended Return” tool to check the status three weeks after filing. The application provides updates on returns for the current tax year and up to three prior tax years. The status might show as received, adjusted, or completed, each indicating a different stage in the process.

If it’s been longer than 20 weeks, and your return hasn’t been processed, it may be due to errors, incompleteness, the need for additional information, or other factors. The tool cannot provide information on certain returns, including carryback applications, injured spouse claims, or those processed by specialized units.

Conclusion

Filing an amended return can be a necessary step in correcting errors or changes to a tax return. The IRS’s “Where’s My Amended Return” tool is a valuable resource to track the status of these returns. Understanding the timeline, eligibility for electronic filing, and common FAQs can streamline the process and provide clarity to taxpayers navigating the complexities of amended returns.

More Articles:

- Breaking: IRS Waives Penalties for Over 5 Million Taxpayers – Details Revealed!

- Ohios Share: Exploring the Range of IRS Tax 4th Stimulus Check Payments

- Health Stimulus Card 2023: Understanding the Plan, Eligibility, and Activation Process

- Health Stimulus Card 2023: Understanding the Plan, Eligibility, and Activation Process

- Guide to Facebook Settlement Checks Status 2023: Types, Forms, and Payouts Explained