Taxes are due on April 15 for most states in the U.S., but Maine and Massachusetts have a later deadline of April 17 because of local holidays. This means that for nearly everyone else in the U.S., today marks the final chance to file your 2023 federal income tax returns with the Internal Revenue Service (IRS) to avoid penalties for late submissions.

IRSNews Twitter handle shared the last date of April 16, 2024 via Twitter-

ENDING TOMORROW: The tax deadline was April 15, 2024 – except for residents of Maine and Massachusetts, who due to state holidays have until tomorrow, April 17, to file their #IRS returns and pay any tax due. https://t.co/pXN7UqUuva

— IRSnews (@IRSnews) April 16, 2024

If you haven’t yet arranged your paperwork, the fastest way to file is online, since mailing your tax returns today won’t reach the IRS in time to avoid penalties.

Here’s how you can quickly pay your taxes online:

- Direct Pay: This is a free service that lets you pay your taxes online directly from your bank account.

- IRS2Go app: Use this app to pay your taxes using your mobile phone.

- Electronic Funds Withdrawal (EFW): This method lets you pay from your bank account as you file electronically via tax preparation software or through a tax professional.

- Electronic Federal Tax Payment System (EFTPS): Ideal for both individual and business taxes, this can be used for payments over the phone or online.

Recent Updates:

- IRS Tax Time Guide 2024: What You Need to Know to Avoid Penalties?

- IRS Extends Deadline for Disaster-Affected Taxpayers in Maine

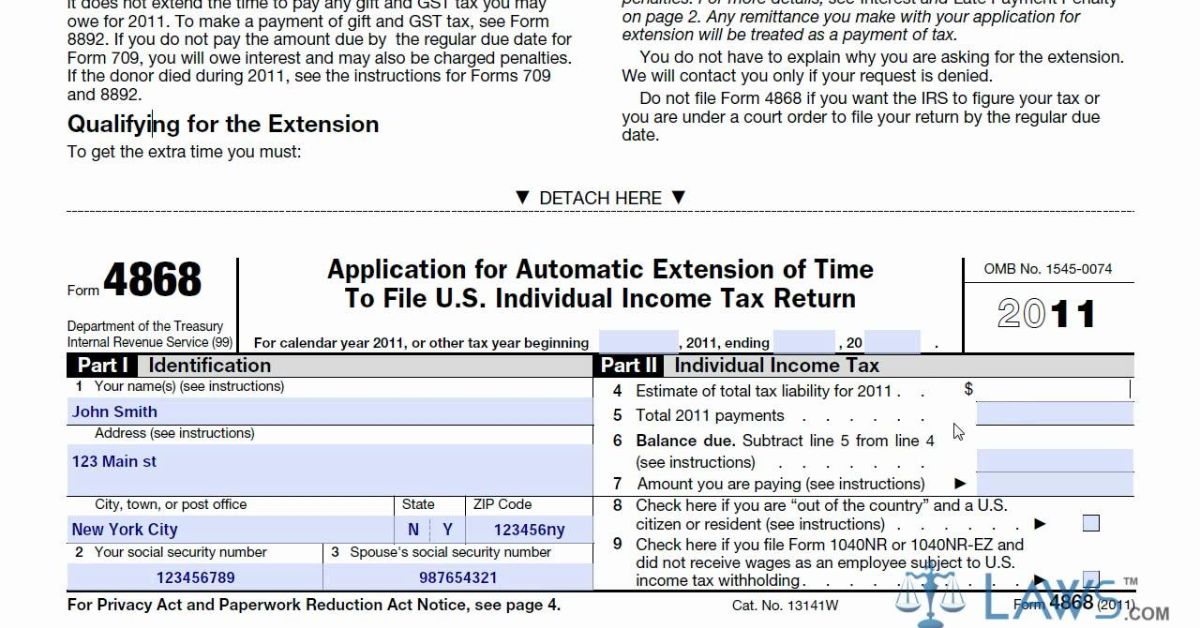

If you need more time to prepare your tax documents, the IRS suggests applying for an extension using IRS Free File. You can fill out Form 4868 for an automatic extension. Remember, you should still estimate and pay any owed taxes by today’s deadline to avoid extra fees.

Extensions are automatically granted under certain conditions such as being on international duty as a U.S. military member, living outside the U.S., or residing in a declared disaster zone.

For those unable to pay all taxes due by the deadline, the IRS recommends paying as much as you can now and applying for one of two payment plans:

- Short-term payment plan: This plan is for durations of 120 days or less with less than $100,000 due in total.

- Long-term payment plan: This plan spreads payments over more than 120 days with less than $50,000 due.

If you don’t qualify for these plans, consider requesting an installment agreement using Form 9465.

Remember, it’s better to file for an extension or submit some payment rather than none at all to reduce penalties for late filing.