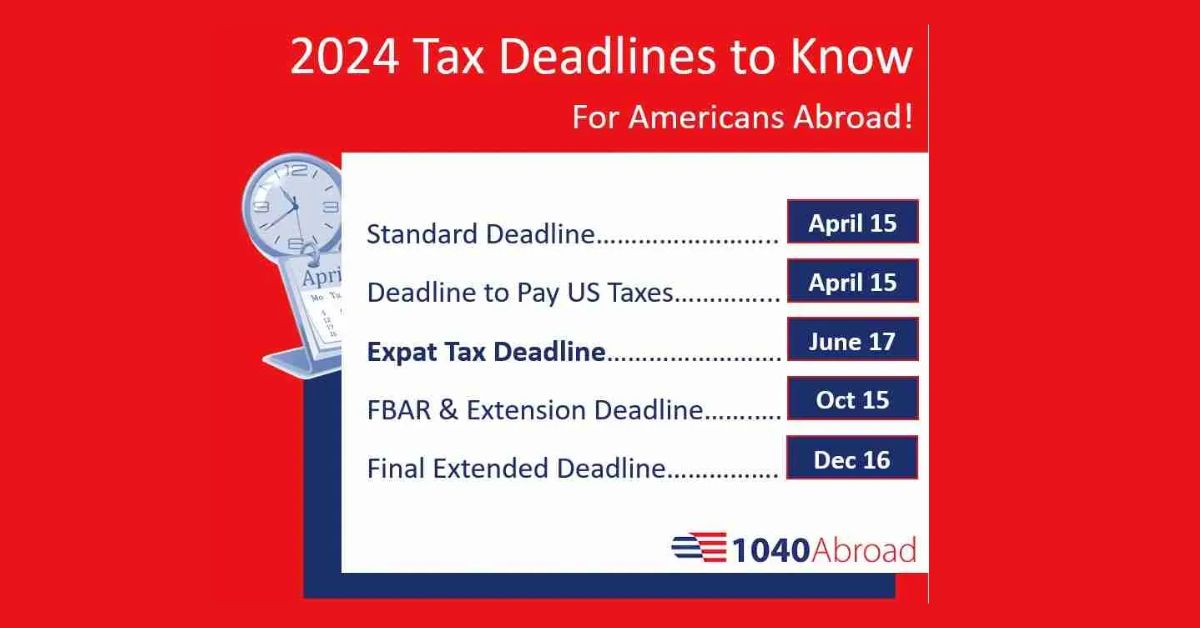

If you’re an American living outside the US, you’ve got extra time to file your taxes this year. The usual deadline is April 15, but if you’re living or working abroad, or if you’re on military duty outside the US, you can file your taxes by June 17, 2024.

Who Gets This Extra Time?

- Living Abroad: If your main home or work is outside the US and Puerto Rico, you can file later.

- Military Service: If you’re in the military and stationed outside the US and Puerto Rico, you also qualify for this extra time.

When you file your tax return, make sure to include a note saying why you’re eligible for the later deadline.

What if You Need More Time?

You can ask for more time to file your tax paperwork, extending the deadline to October 15, 2024. However, if you owe any tax, you still need to pay it by June 17.

You can also see the recent tweet by @IRSnerws for this above statement, shared on Apr 15, 2024, at 3:50 am

If you’re serving in the military outside the U.S. and Puerto Rico on the regular due date of your tax return, you have until June 17, 2024 to file your 2023 #IRS tax return. https://t.co/djibPmyBbu pic.twitter.com/nBlfxH9Rlf

— IRSnews (@IRSnews) April 14, 2024

Special Note for Some Taxpayers

Some Americans living in places like Israel, Gaza, or the West Bank might have until October 7, 2024, to file and pay taxes because of disruptions caused by recent events. Check the IRS notice for more details.

Benefits for Filing

Even if you live abroad, you might get some tax breaks, like not having to pay taxes on some of the money you earn overseas and getting credit for taxes you pay to other countries. But you need to file a US tax return to get these benefits.

Recent Updates:

- IRS Extends Deadline for Disaster-Affected Taxpayers in Maine

- Tax Update: IRS Extends Deadline for Taxpayers in 2 States

Reporting Foreign Bank Accounts

Don’t forget to report any foreign bank or financial accounts you have:

- On Your Tax Return: Use Part III of Schedule B to list foreign accounts.

- Form 8938: If you have a lot of money in these accounts, you might also need to fill out Form 8938.

- FBAR (Foreign Bank Account Report): If at any time in 2023, the total value of your foreign financial accounts was over $10,000, you must file an FBAR electronically by April 15, 2024. There’s an automatic extension to October 15, 2024, if you miss the April deadline.

Currency Conversion

When you report money amounts, convert everything to US dollars using the exchange rate from December 31 of the tax year. The IRS is okay with any exchange rate you use regularly.

For more details about tax filing for US citizens living abroad, you might want to check additional resources or professional advice to ensure everything is correct.