Have you ever wondered how much money you could save on taxes just by going to school or paying for someone’s education? Every year, many students and parents miss out on significant tax savings simply because they’re not aware of the tax benefits available for education.

But what if you could turn your educational expenses into potential tax savings? Let’s dive into how you can make education more affordable through tax benefits.

What Are Tax Benefits for Education?

Tax benefits for education are designed to help reduce the financial burden on students and families. These benefits can take the form of credits, deductions, and savings plans, each providing a unique advantage:

- Tax Credits: Directly reduce the amount of tax you owe.

- Tax Deductions: Decrease your taxable income, which can reduce your overall tax bill.

- Savings Plans: Help grow your educational funds tax-free or allow you to make tax-free withdrawals for educational expenses.

Recent Updates:

- Avoid the Fines: How to File Your IRS Taxes Online in Record Time?

- Job Opening: IRS Translator (Bilingual-Spanish) TERM NTE 13 months

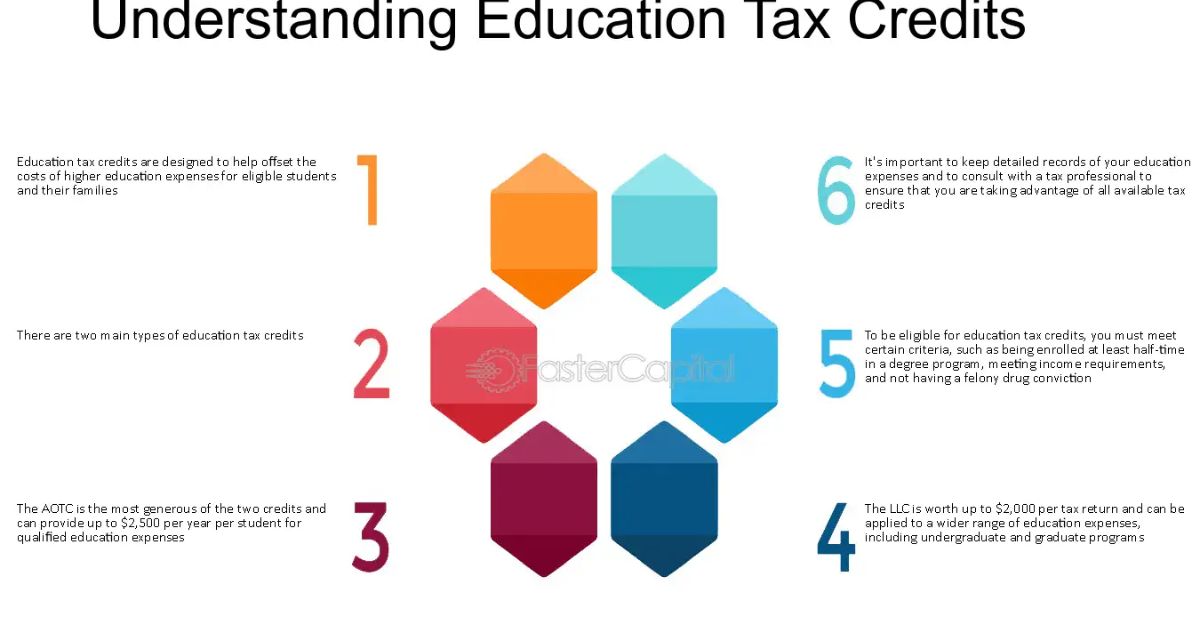

Understanding Tax Credits for Education

Tax credits are among the most beneficial tax features for students and families. Here’s how they work:

-

American Opportunity Tax Credit (AOTC)

- Who’s Eligible? Students in their first four years of higher education or their parents claiming them as dependents.

- Key Benefits: Reduce your tax bill by up to $2,500 per eligible student. If the credit exceeds the amount of taxes you owe, it might result in a refund.

- How to Claim: You’ll need to file Form 8863 with your tax return.

-

Lifetime Learning Credit (LLC)

- Coverage: Unlike the AOTC, the LLC is not limited to the first four years of college and can be used for undergraduate, graduate, and professional degree courses.

- Benefit: Offers a credit of up to $2,000 per tax return.

- Claim Process: Claim it on Form 8863.

Exploring Tax Deductions Related to Education

Deductions are another way to manage the costs of education through tax benefits. They work by reducing your taxable income:

- Tuition and Fees Deduction: You might be able to deduct expenses for tuition and fees, which can lower the amount of your income subject to tax.

- Student Loan Interest Deduction:

- Eligibility: Available if you’re paying interest on student loans and your modified adjusted gross income is below a certain threshold.

- Benefit: Deduct up to $2,500 in student loan interest, which can reduce your taxable income.

- Claiming This Deduction: It’s an adjustment to income, meaning it’s available whether you itemize deductions or not.

Note: IRSnews Shared a tweet on Apr 24, 2024, with the caption- “Many students, including those attending community colleges, face financial challenges. Let’s make it easier for them to find the #IRS tax benefits they’re eligible to claim:”……

Many students, including those attending community colleges, face financial challenges. Let’s make it easier for them to find the #IRS tax benefits they’re eligible to claim: https://t.co/TfPnkdPp7y #CommunityCollegeMonth

— IRSnews (@IRSnews) April 23, 2024

Benefits of Education Savings Plans and Income Exclusions

Savings plans and exclusions are crucial for long-term planning:

- Education Savings Plans: Plans like 529s and Coverdell Education Savings Accounts offer tax-free earnings growth and withdrawals when used for qualified educational expenses.

- Exclusions from Income: Scholarships, grants, and certain fellowships don’t count as taxable income if used for qualified educational expenses, though they can’t be used to claim other tax benefits.

Special Considerations for Foreign Students and Dependents

- If you or your dependents are foreign nationals, you might face additional requirements, especially if claiming the AOTC. Make sure to review the eligibility criteria carefully.

Utilizing IRS Tools and Publications

- Use tools like the IRS’s Interactive Tax Assistant and consult Publication 970 to understand and navigate the specifics of educational tax benefits.

Final Thoughts

Navigating the world of tax benefits for education can significantly reduce the financial strain of your educational journey. By understanding and utilizing these tax credits, deductions, and savings plans, you can make your or your dependent’s education more affordable.

Always consider consulting with a tax professional to maximize your benefits and ensure compliance with tax laws.

Contents