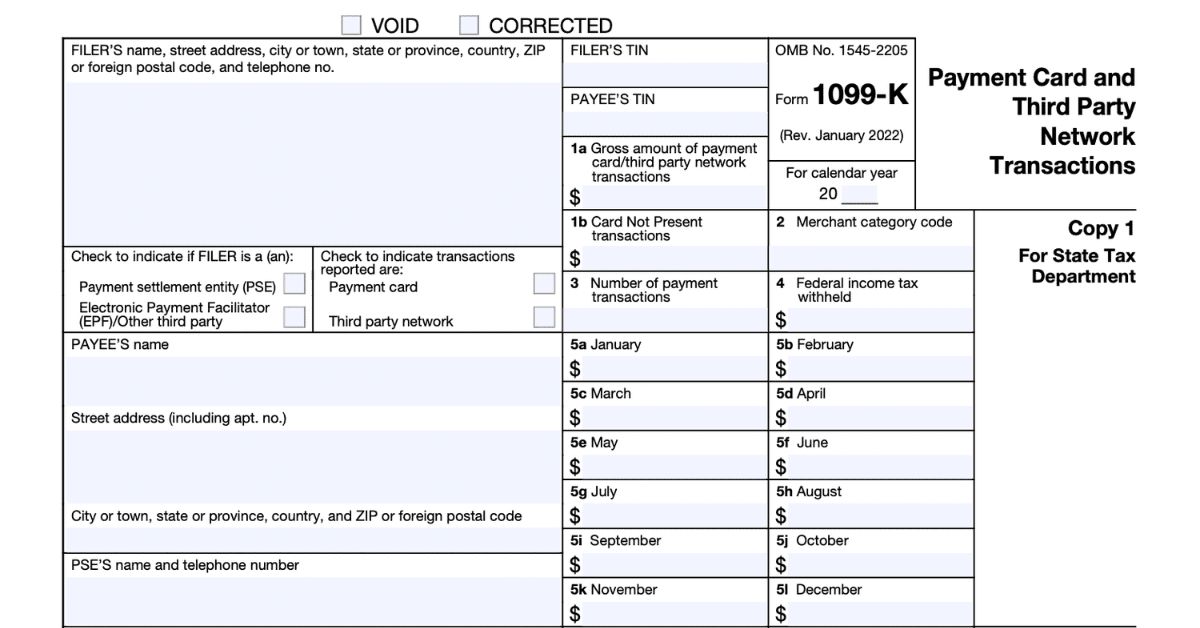

Form 1099-K is an essential document in the world of taxation, ensuring accurate reporting of payments received for goods or services. This guide will help you understand Form 1099-K, who gets it, and how to use it correctly to avoid potential tax issues.

Understanding Form 1099-K

What is Form 1099-K?

Form 1099-K is an IRS document used to report payments received from various sources, including payment cards, apps, and online marketplaces. It’s designed to help taxpayers accurately report their business income. The form distinguishes between business transactions and non-taxable personal payments.

Who Sends Form 1099-K?

- Payment Card Companies: Providers of credit and debit cards.

- Payment Apps and Online Marketplaces: Organizations like PayPal, Venmo, Etsy, and others.

- Third-Party Settlement Organizations (TPSOs): Intermediaries facilitating transactions between buyers and sellers.

Who Receives Form 1099-K?

You will receive a Form 1099-K if you:

- Accept payments directly via credit or debit cards for your business.

- Use payment apps or online marketplaces, exceeding $20,000 from over 200 transactions. Some companies may issue the form for lower amounts.

Recent Updates:

- IRS is Hiring Economists Across the Country-Apply Today!

- Avoid the Fines: How to File Your IRS Taxes Online in Record Time?

Reporting Income and Tax Implications

Reporting Threshold and Changes

For 2023, payment apps and marketplaces will file a 1099-K for those meeting the $20,000 and 200 transaction thresholds. However, the American Rescue Plan Act of 2021 intended to lower this threshold to $600, but implementation was delayed.

Additional information-

Recently IRSsmallbiz shared a tweet on Tuesday, 30 April 2024 with the caption ” If you sell items or provide a service and get paid by payment card or through a payment app, you may get a Form 1099-K reporting those transactions. Learn more by watching an #IRS video: youtu.be/TojpxBWKTNo”

If you sell items or provide a service and get paid by payment card or through a payment app, you may get a Form 1099-K reporting those transactions. Learn more by watching an #IRS video: https://t.co/NDpdK2xXtw pic.twitter.com/VBLpnJOGoB

— IRS Small Biz (@IRSsmallbiz) April 29, 2024

Correct Reporting of Business Income

Use Form 1099-K alongside other records to ensure accurate income reporting. Beware of double-reporting, especially if multiple forms cover the same transactions. Personal payments from family and friends should not appear on the form.

Practical Guidance for Recipients of Form 1099-K

- Use Form 1099-K Properly: Cross-check with your business records.

- Maintain Accurate Records: Track all transactions and keep personal payments separate.

- Determine Your Tax Obligations: Consult a tax professional to avoid errors.

- IRS Resources: Visit IRS.gov for more guidance.

Note: IRSnews Shared a complete guide about Form 1099-k Via tweet on Thursday, 2 May 2024 which is given below-

Interested in learning more about Form 1099- K? Visit: https://t.co/mH37nxEDJg pic.twitter.com/ivA81b8gS2

— IRSnews (@IRSnews) May 1, 2024

Conclusion

Form 1099-K plays a crucial role in accurately reporting business income. Understanding how to use it correctly will help you navigate tax season smoothly. Stay informed, keep accurate records, and seek professional advice to ensure compliance.