Stimulus checks, a term that has become a household name over the past few years, signify the government’s financial aid to individuals during tough economic times. Initially introduced at a federal level to combat the economic downturn caused by unforeseen circumstances like the global pandemic, these checks played a crucial role in providing some financial relief to the citizens.

The year 2023, however, brought a shift in this initiative from a federal to a state level. Unlike previous years, there are no federal stimulus checks planned for 2023, differing from the anticipation surrounding the 4th Stimulus Check Release Date. This transition stems from the IRS’s statement on the absence of federal stimulus checks for 2023, pushing states to devise their own stimulus programs to cater to the economic needs of their populace.

The state-level stimulus checks are tailored to address the unique economic challenges faced by each state, making them a more localized solution to the financial hurdles encountered by individuals. While the concept of stimulus checks remains the same, the execution and impact at a state level exhibit a new chapter in the ongoing narrative of financial aid during trying times.

This shift not only reflects the evolving governmental strategies in addressing economic crises but also showcases a proactive approach by states in ensuring the financial well-being of their citizens in the absence of a federal stimulus check initiative for the year 2023.

As we delve deeper into this topic, we’ll explore various state-level stimulus programs, their impact on the citizens, and the broader economic implications they entail for the year 2023.

Stimulus Check 2023: Federal vs State Level Initiatives

The year 2023 marked a significant deviation from the federal stimulus check approach we witnessed in previous years. According to the IRS, there were no federal stimulus checks designated for this year. This lack of federal financial relief prompted individual states to step in and formulate their own stimulus check programs to aid their residents amidst the continuing economic challenges.

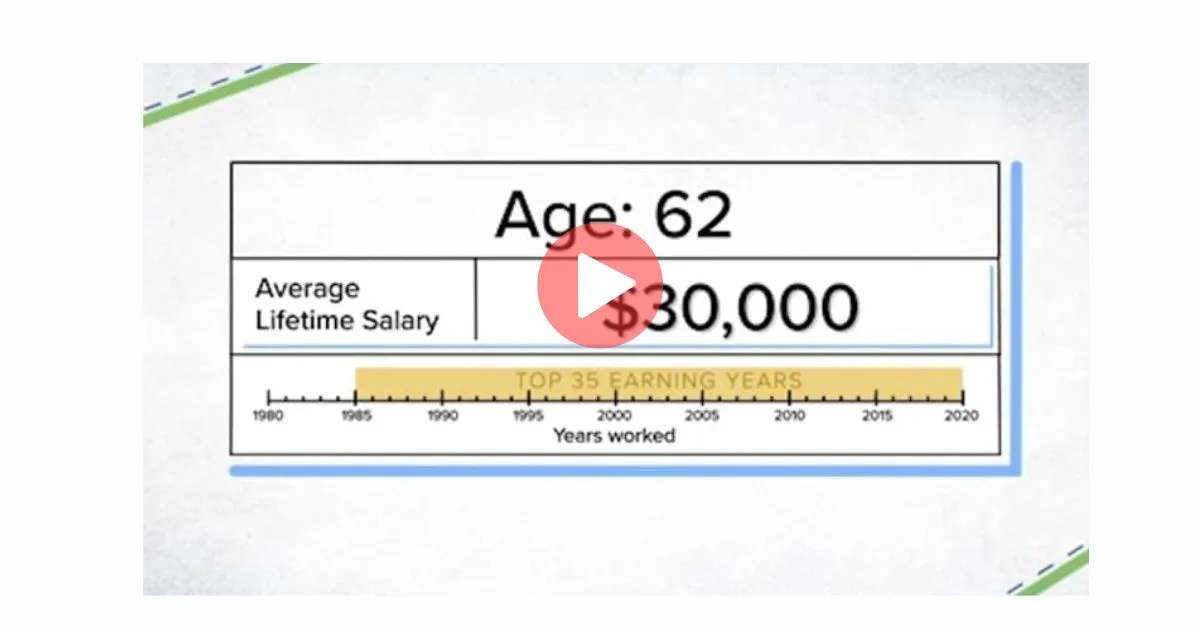

State-level stimulus checks, although guided by a similar intention of providing financial relief, vary significantly from the federal stimulus checks in terms of eligibility criteria, amount disbursed, and the distribution mechanism.

While federal stimulus checks had a broader, more generalized eligibility criteria, state-level stimulus initiatives are tailored to the specific economic conditions and needs of their respective states. This localized approach allows for a more targeted aid distribution, addressing the financial disparities and economic challenges unique to each state.

A Closer Look at State Stimulus Programs

Delving into the state stimulus programs reveals a spectrum of initiatives aimed at alleviating financial burdens on individuals and families. States like Alaska commenced the disbursement of stimulus checks from Juneau starting October 26, 2023, aiming to provide some financial relief to the residents facing economic hardships.

These state-driven stimulus programs are formulated to address a range of issues including unemployment, cost of living adjustments, and economic revitalization. Eligibility criteria and stimulus check amounts vary across states, while also considering the 2024 Social Security COLA Expectations.

For instance, some states issued payments between October 2022 and January 2023 to provide a financial cushion to their residents during the winter months.

The transition from federal to state-level stimulus checks underscores a significant shift in the approach towards providing financial assistance. As we progress through 2023, the impact and efficacy of these state-level stimulus programs continue to unfold, shedding light on a new model of economic support and its potential to address financial needs at a more granular level.

Impact of State Stimulus Checks on Tax Refunds

The interplay between state stimulus checks and tax refunds is a crucial aspect to consider as we navigate through the fiscal landscape of 2023. Unlike federal stimulus checks, which were considered tax-free, the tax implications of state stimulus checks can vary.

According to IRS guidelines, individuals may need to report these payments on their state tax returns, which could potentially affect the amount of their tax refund or tax liability.

Furthermore, the manner in which state stimulus payments are classified – as taxable income or tax-free assistance – can significantly influence individual tax obligations. This distinction, in turn, affects the amount of state tax refunds individuals might receive. It’s essential for recipients of state stimulus checks to consult with tax professionals or refer to their state’s tax guidelines to understand the implications of these payments on their 2023 tax refunds.

The tax implications of the state stimulus checks have generated discussions among individuals, as reflected in the following tweet:

Clearly some people don’t know how the stimulus checks worked, who’s money it actually was/is and how it go distributed…

🤣🤣🤣🤣…. People believe anything https://t.co/lhvCgBWmtB

— the Old Man Ebro (@oldmanebro) October 3, 2023

Breakdown by State: Who Gets What?

The distribution of state stimulus checks in 2023 exhibits a diverse range of amounts and eligibility criteria, reflecting the unique economic conditions of each state. For instance, certain states initiated payments between October 2022 and January 2023 to offer financial respite during the colder months.

The eligibility criteria for these state stimulus checks are often based on income levels, employment status, and other financial circumstances unique to each state’s populace. The amount disbursed also varies, with some states providing a one-time payment, while others have opted for multiple smaller payments to provide ongoing support.

A thorough examination of various state government websites and announcements provides a clearer picture of the stimulus check amounts and eligibility criteria across different states. This detailed breakdown not only offers a glimpse into the financial assistance available but also highlights the states’ proactive measures in addressing the economic hardships faced by their residents amidst the absence of federal stimulus checks in 2023.

Receiving the Stimulus: The Process

The procedure for receiving state stimulus checks varies across different states, however, there’s a common process that eligible individuals can anticipate.

Firstly, eligibility is determined based on a variety of factors including income levels, employment status, and other state-specific criteria. Once eligibility is confirmed, individuals are typically required to complete an application or claim process through their respective state’s governmental website or through mailed forms.

In line with Social Security Fairness, the process of disbursement will commence on October 26, 2023, starting in Juneau. Residents were notified about their eligibility and the steps required to claim their stimulus checks through official communications. The checks were then distributed either through direct deposit to bank accounts or mailed as paper checks to eligible individuals.

It’s imperative for individuals to stay updated with their state’s guidelines and deadlines to ensure they receive the stimulus aid they’re entitled to. Consulting state government websites or contacting local governmental offices can provide the necessary information on the process of receiving these state stimulus checks.

The process of receiving the state stimulus checks has been a topic of discussion among residents, as seen in this tweet:

Donald Trump held up stimulus checks because he wanted his signature on them.

Joe Biden quietly negotiated the release of American hostages in Gaza, doesn’t pat himself on the back and is just happy they’re free.

I know who the better man is.pic.twitter.com/LKHe396DKH

— Christopher Webb (@cwebbonline) October 21, 2023

Public Reaction to State-Level Stimulus Checks

The distribution of state-level stimulus checks has elicited a variety of reactions from the public. While many appreciate the financial support during challenging times, others express concerns regarding the adequacy and distribution of these funds.

Social media platforms have become a hub for individuals to share their experiences and opinions regarding the state stimulus checks. Through tweets, Facebook posts, and other social media outlets, people express their gratitude, frustrations, and suggestions for improving the state stimulus initiatives.

A variety of responses have been shared on social media regarding the state-level stimulus checks. One Twitter user expressed their gratitude for the financial support:

The stimulus checks and PPP loans all these people remember. 😭 https://t.co/arcmMsTckv

— nope (@PrinceHAK33M) August 15, 2023

On the other side, some individuals have voiced their concerns regarding the adequacy of the funds, as seen in this tweet:

BREAKING: The Biden administration and Congress has announced new stimulus checks to help struggling citizens. The only requirement is you have to be a Ukrainian citizen and live in Ukraine.

— 🇺🇸Travis🇺🇸 (@Travis_4_Trump) August 30, 2023

Various suggestions for improving the state stimulus initiatives have also been put forward by the public on social media platforms:

Trump locked down the country & gave the keys to Fauci.

Trump had corporations make all of those ventilators.

Trump signed a 2 trillion dollar bill and sent out the stimulus checks.

Trump took money from big pharma.

Trump is the father of Operation Warp Speed and the…

— Morgan Ariel (@itsmorganariel) September 14, 2023

The importance of these state-level stimulus checks cannot be understated as they provide a critical financial lifeline to many facing economic hardship. Additionally, these initiatives reflect the states’ commitment to supporting their residents in the absence of federal stimulus checks, showcasing a proactive approach towards alleviating financial distress.

The impact of these state stimulus programs extends beyond individual financial relief, contributing to the broader economic stability and recovery. As residents spend their stimulus funds, local businesses and economies also benefit, creating a ripple effect of financial activity and support within the communities.

Future Implications

The unfolding of state-level stimulus programs in 2023 opens up discussions on the future of stimulus checks, both at federal and state levels. The decision of individual states to provide financial relief indicates a precedent where states can step in to address economic challenges within their territories.

This new paradigm may encourage other states to develop similar initiatives, especially if positive economic impacts are observed.

On the federal front, the absence of a federal stimulus check in 2023 does not rule out the possibility of such a program in subsequent years, especially if the country faces economic challenges that necessitate federal intervention. The coordination between federal and state governments in providing financial aid will likely continue to evolve, taking into consideration the economic landscape and the financial needs of the populace.

The economic implications of state-level stimulus programs are far-reaching. They not only provide immediate financial relief to individuals but also have the potential to stimulate local economies, support small businesses, and promote economic recovery and stability.

The discussions regarding the future of stimulus checks continue on social media platforms, with some individuals advocating for further state-led initiatives:

I’m going to say this one time ONLY! TRUMP AINT SEND Y’ALL STIMULUS CHECKS! In fact, he possibly delayed them b/c he wanted his name on them. THANK The Dem Congress for the checks! NO President has that type of power, alone, over the purse & well he doesn’t pay his own bills! 🛑

— Jasmine Crockett (@JasmineForUS) October 4, 2023

Conversely, others argue about the need for federal intervention in subsequent years, as discussed in the following tweet:

#Powell blamed today's #inflation on the #pandemic. The pandemic didn't cause inflation, the #Fed and the Federal Government did. Both made the inflation problem worse during the pandemic by running huge budget deficits and printing a shitload of money to finance stimulus checks.

— Peter Schiff (@PeterSchiff) October 19, 2023

Conclusion

The narrative of stimulus checks in 2023 highlights a significant transition from federal to state-led financial relief initiatives. The various state stimulus programs designed to provide financial assistance reflect a proactive approach by states in addressing the economic hardships faced by their residents.

The impact of these programs extends beyond individual financial relief, contributing to the broader economic stability and recovery. The responses and reactions from the public further underscore the importance of these initiatives in providing a financial lifeline during challenging times.

As we reflect on the evolving landscape of stimulus checks, the potential for future state or federal stimulus initiatives remains a topic of interest, especially in the face of economic uncertainties. The tale of stimulus checks in 2023 serves as a testament to the adaptive measures taken by governmental entities in ensuring the financial well-being of the citizens.

Disclaimer

The information provided in this article is for informational purposes only and not for the purpose of providing financial advice. It’s important to consult with a qualified financial advisor or your local government’s official guidelines to understand the implications and eligibility concerning state stimulus checks. The details and discussions presented are based on the information available as of October 2023 and may be subject to change.

Contents

- 1 Stimulus Check 2023: Federal vs State Level Initiatives

- 2 A Closer Look at State Stimulus Programs

- 3 Impact of State Stimulus Checks on Tax Refunds

- 4 Breakdown by State: Who Gets What?

- 5 Receiving the Stimulus: The Process

- 6 Public Reaction to State-Level Stimulus Checks

- 7 Future Implications

- 8 Conclusion

- 9 Disclaimer