When considering retirement, individuals face crucial decisions regarding their Social Security benefits. While the system offers various claiming options, some unconventional strategies have emerged, including the “Free Loan from Social Security” strategy. This brief explores this unique approach and its potential impact on retirees and the Social Security system.

Understanding the Strategy

The “Free Loan from Social Security” strategy allows individuals to claim early Social Security benefits and later pay back the principal while keeping the interest accrued. Essentially, it offers a temporary boost in income without permanently reducing future benefits. This unconventional approach appeals to those seeking financial flexibility or investment opportunities.

Key Findings

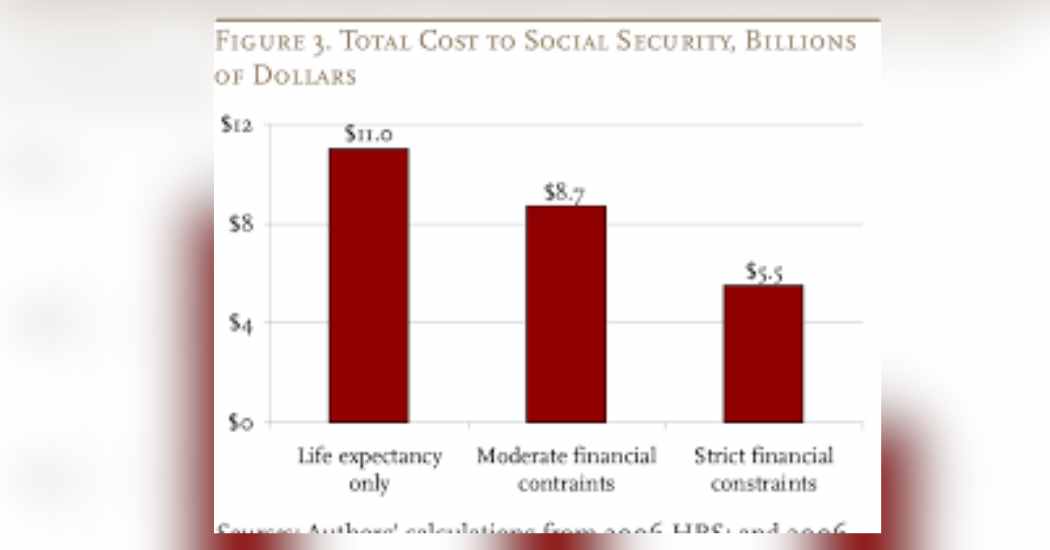

- Cost to Social Security: If widely adopted, this strategy could cost the Social Security system between $6 billion to $11 billion annually, with projections indicating increasing costs over time.

- Beneficiary Profile: Primarily benefiting higher-income individuals, this strategy favors those with financial resources to invest their benefits and better health prospects.

Impact and Implications

- System Costs: The potential increase in Social Security costs raises concerns about the sustainability of the program and its long-term financial health.

- Beneficiary Equity: The strategy’s disproportionate benefit to higher-income individuals highlights equity issues within the Social Security system, potentially exacerbating income inequality.

- Regulatory Response: Recognizing the implications, the U.S. Social Security Administration implemented limitations on this strategy in 2010 to mitigate its adverse effects.

Conclusion

While the “Free Loan from Social Security” strategy offers temporary financial advantages to certain individuals, its widespread adoption could strain the Social Security system and exacerbate existing inequities. Regulatory measures are essential to safeguard the program’s integrity and ensure equitable distribution of benefits among retirees.

As policymakers navigate the complexities of retirement planning, addressing unconventional strategies like this one remains crucial for the sustainability of Social Security and the well-being of future retirees.

Related News-