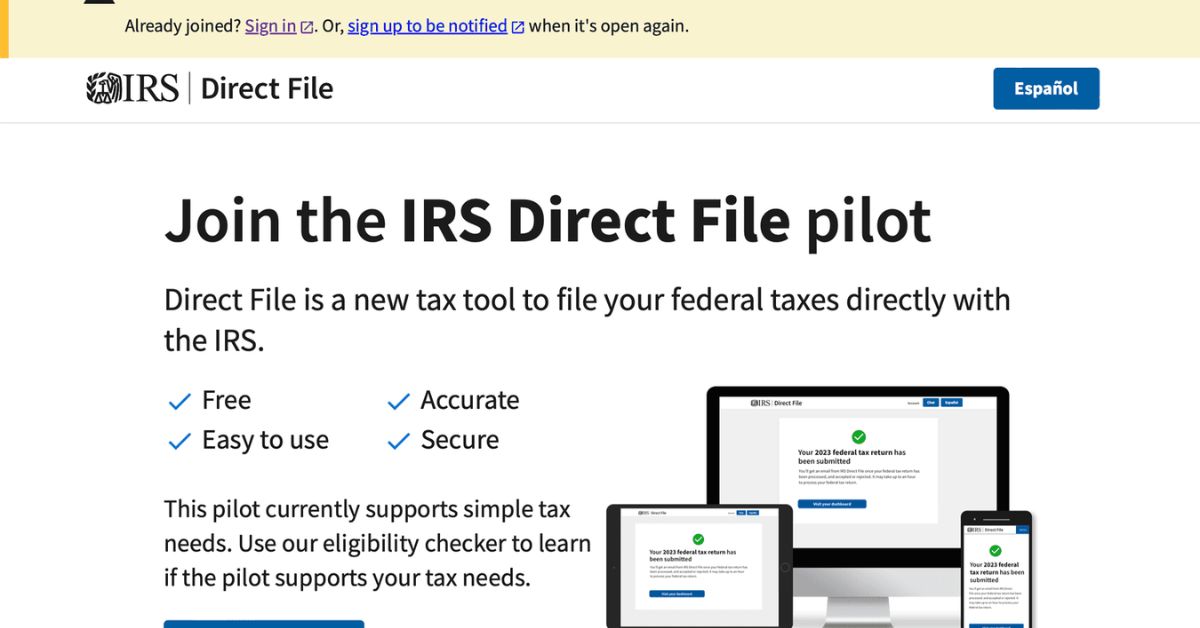

The Internal Revenue Service (IRS) has initiated a groundbreaking pilot program called Direct File, offering eligible individuals in Florida the opportunity to file their federal tax returns online for free. This innovative service aims to streamline the tax filing process, providing a convenient alternative to traditional methods.

What is a Direct File?

Direct File is a pilot program introduced by the IRS, allowing eligible taxpayers to submit their 2023 federal tax returns electronically without the need for commercial tax software. This initiative is part of the IRS’s efforts to modernize and simplify tax filing procedures, making it more accessible and user-friendly for taxpayers.

Eligibility Criteria

To qualify for the Direct File pilot program, individuals must meet specific criteria outlined by the IRS. Eligible participants include those with simple tax scenarios, such as individuals with income from employment (Form W-2), unemployment benefits (Form 1099-G), Social Security benefits (Form SSA-1099), or interest income (Form 1099-INT) up to $1,500.

Additionally, participants must plan to take the standard deductions and may not have purchased health insurance through a marketplace like Healthcare.gov.

Features and Benefits

Direct File offers several advantages for eligible taxpayers. Participants can file their federal tax returns for free, receive step-by-step guidance, and access real-time online support from IRS customer service representatives.

The program is designed to be user-friendly, allowing taxpayers to complete their returns conveniently from smartphones, laptops, tablets, or desktop computers. Moreover, Direct File allows individuals to start their tax return and resume it later, providing flexibility and convenience.

IRS Direct File program now open to more taxpayers https://t.co/Ydc60uBFQT

— Mashable (@mashable) March 5, 2024

How to Use Direct File?

To utilize the Direct File pilot program, individuals must visit the Direct File website and determine their eligibility. If eligible, taxpayers can create an IRS account, enter their tax information, and check whether they are due a refund or owe taxes before submitting their return to the IRS.

The program is expected to be more widely available by mid-March, with plans to expand beyond Florida to other states.

Key Differences from IRS Free File

It’s essential to distinguish Direct Files from IRS-free files. While both programs offer free tax filing options, Direct File is specifically designed for individuals with simple tax scenarios and does not partner with tax software companies. IRS Free File, on the other hand, collaborates with tax software companies to provide free filing for individuals earning $79,000 or less.

Conclusion

The IRS Direct File pilot program represents a significant step forward in modernizing and simplifying the tax filing process. By offering eligible taxpayers a free and user-friendly alternative to commercial tax software, the IRS aims to make tax filing more accessible and efficient for all.

With its phased rollout and anticipated expansion, Direct File promises to revolutionize how individuals file their federal tax returns, paving the way for a more streamlined and inclusive tax system.