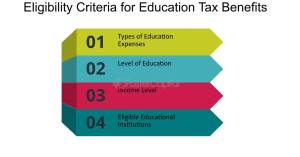

Tax Benefits for Education 2024

Vishal Sani

Meet Vishal Sani, the storyteller at SilentNews.org, where headlines transform into engaging tales for easy understanding. Join him on a journey simplifying the world through storytelling. Explore SilentNews.org for news that resonates with you.

View all posts by Vishal Sani →