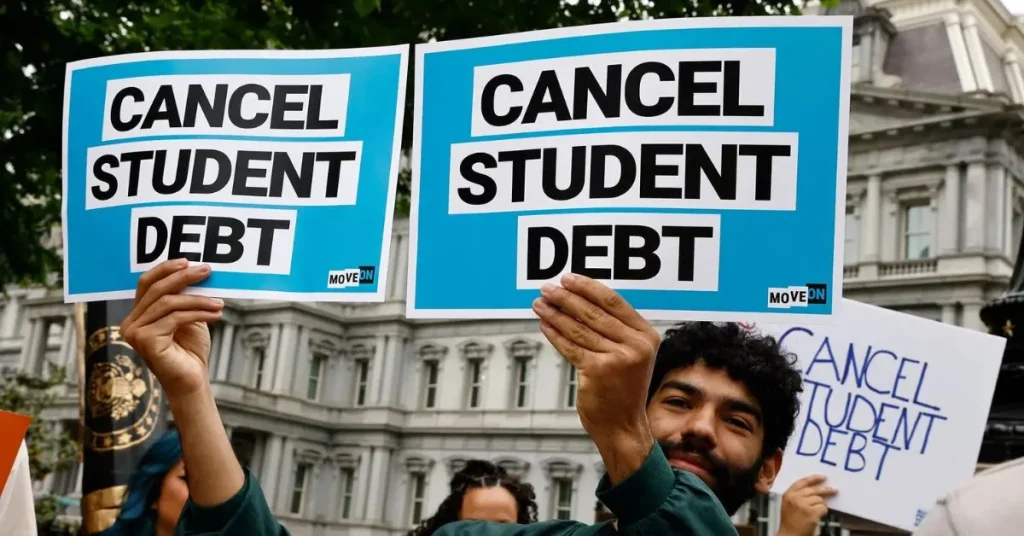

The Department of Education (ED) recently started emailing federal student loan borrowers with at least one loan owned by the ED. The emails tell these borrowers about possible student debt relief and give them the chance to choose not to receive it.

People who want to be part of the possible student loan relief don’t have to do anything.

I’ve spoken to people who cried after having their student debt canceled.

— Elizabeth Warren (@SenWarren) July 13, 2024

These are hardworking people — public school teachers, city employees — who can now save up money to buy a house, or start a family, or retire.

Student loan debt cancellation is life changing.

This announcement tells institutions how borrowers can choose not to get help with their student loans and where to send questions from borrowers or students who contact the institutions.

Plans for reducing student debt

President Biden announced new plans to discuss new rules that would get rid of student loan debt under the Higher Education Act. The new rules are not set in stone yet. If these rules are put into place the way they were meant to be, they will allow for partial or full student loan forgiveness in the following situations:

Who owes more than they did at the beginning of repayment

If you have an unconsolidated Direct Loan, a Federal Family Education Loan (FFEL) Program loan, or a Perkins Loan, the amount you still owe is more than what it was when you started paying it back.

here are some comments from people:

I spoke to many people who feel betrayed because many of us paid for over 15 years to pay off our student loan debt.

I spoke to many people who feel betrayed because many of us paid for over 15 years to pay off our student loan debt.

— Brian Bowen @ ColR (@madartist23x) July 13, 2024

I’ve spoken to plumbers who cry because they can’t make their truck payment. They couldn’t afford college, and now they have to pay for the people who could.

I’ve spoken to plumbers who cry because they can’t make their truck payment. They couldn’t afford college, and now they have to pay for the people who could.

— Woke Inoculum (@WokeInoculum) July 13, 2024Go back to your reservation.

Go back to your reservation.

— Marshal Earp (@GRAYMAN1357) July 13, 2024

The amount still owed on a consolidation loan is higher than the total amount owed on the loans that were merged when they started being paid back.

People who borrowed money and started paying it back a long time ago

This person only has student debts, and at least one of them started being paid back before July 1, 2005. That person either has at least one graduate loan or started paying back at least one of their bachelor or graduate loans before July 1, 2000.

People who really should have asked for loan forgiveness but haven’t yet

The borrower hasn’t signed up for an income-driven payback (IDR) plan yet, but they could get help if they did. Or, the borrower might be qualified for closed school discharge or other types of loan forgiveness, but they haven’t been able to get that help yet.

People who borrowed money and signed up for low-value programs

The person who borrowed money went to a school that didn’t offer enough cash value.

The borrower went to a school that didn’t meet one of ED’s standards for responsibility.

Read more: The Pastor Chris Hodges Scandal: A Reckoning for a Megachurch Leader

Keep in mind that the final rules will probably only affect people who already have loans that they are paying back.

Student Loan Debt Relief Opt-Out

On Thursday, August 1, 2024, ED started sending emails to people who have at least one loan owned by ED. These emails told people about updates on possible student debt relief and told them they had until August 30, 2024, to contact each of their ED loan servicers and say they didn’t want this relief.

It could take up to seven days to send emails to all of the borrowers who have at least one loan kept by ED. Some borrowers haven’t started paying back their loans yet or are still registered at your school in the email distribution. This is because those borrowers may have started paying back their loans by the time the new rules come out.

The rules that would allow this relief have not been approved yet, and the email does not promise that the specific borrowers will be able to get it. Once the rules are approved this fall, ED will give borrowers more information.

However, if a borrower opts out, they won’t be able to opt back in. People who choose to opt out will also not be able to get their loans canceled under income-driven repayment (IDR) for a few months.

This option to not pay is only for people whose federal student loans are held by the ED. It does not apply to business FFEL borrowers or people whose Perkins Loans are held by institutions.

Visit to find out more about how to get rid of student loans and what is being offered right now.

Questions for Students and Borrowers

Schools may get emails from current and past students with federal student loans asking about ways to lower their debt and the “opt-out” email. The opt-out email tells borrowers not to contact FFEL loan holders.

However, we think that some borrowers may start calling their business FFEL loan holders or their institutions to ask general questions or to opt out of debt relief.

To make sure that these borrowers’ questions and requests are properly handled, schools should send them to the companies that service their ED-held student loans to make sure that their opt-out requests are sent in by August 30. This will also make sure that these borrowers get proper information from their loan servicers about the possible waivers.

As of now, the proposed debt relief has not been finalized. This means that students and borrowers will not be able to find out from their servicer if they are qualified for student debt relief.